The Smart Mortgage & Lending Process.

Life is busy and time is precious. It’s a no-brainer to want to find ways to make the complex more simplified.

In collaboration directly with our accounting and financial planning team, our strategic mortgage brokers will assist you whether

you’re looking into loans for property or businesses, SMSF loans or equipment finance.

Our mortgage & lending process involves us getting to know your finer details, including your current situation and your goals. We

will analyse and assess opportunities and make recommendations to assist in achieving your goals.

Our mortgage brokers offer an extra layer of artillery by also being qualified accountants and financial planners.

Why does that matter?

It’s called Strategic Mortgage Advisory – taking a holistic view of your financial life, not just

the loan you need right now.

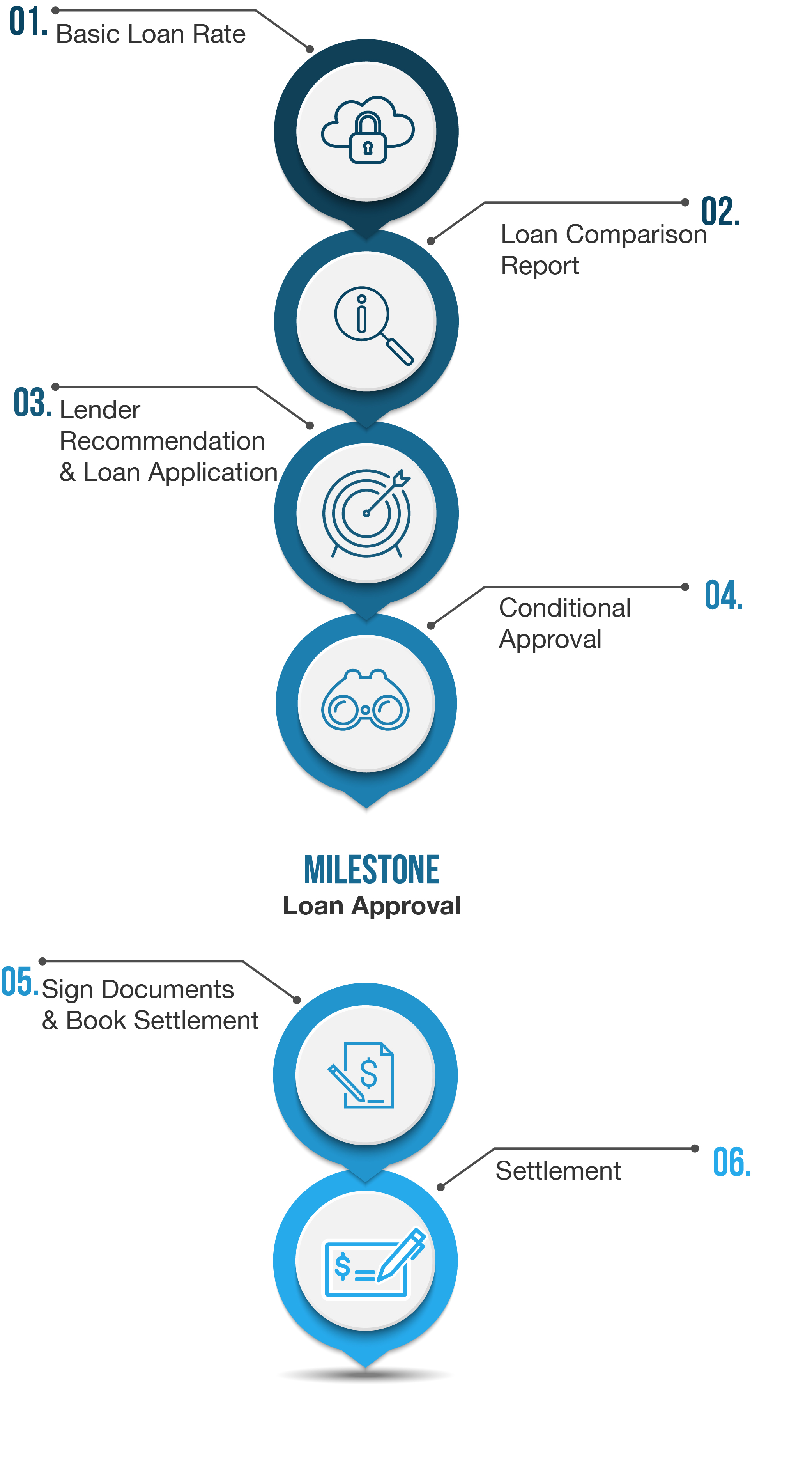

Step 1: Basic Loan Rate

To provide you with a basic loan rate we’ll start with gathering an understanding of your goals and

what you’re trying to achieve.

Here’s an overview of some of the questions we’ll ask you:

Your name and contact details

Purpose of the loan (eg, investment property, renovating, commercial property, SMSF loan

Your income (combined or individual)

Approximate balance owing on existing loans (if applicable)

Estimate on current property value (if applicable)

Key features you want from a loan (eg, redraw, multiple offsets, fixed rate)

Next steps

From the snapshot of information provided by you, we will provide a basic rate via email.

From here, you may choose to accept our offer for a more detailed loan comparison report which gathers and considers more detailed financial

information and will provide a much more accurate forecast of the right loan to suit your needs.

Step 2: Loan Comparison Report

Our Loan Comparison Report offers you a detailed overview of 3-5 lenders that more accurately fit your goals and needs.

Before we can create this report for you, we will need you to:

Sign a privacy and consent form sent to you via email

Complete your details via our secure portal to collect your financial data from the relevant

All of the information you provide will be treated as confidential.

Next steps

Within 24 hours of signing the privacy & consent form , and accessing the secure

client portal ,

we will create a detailed comparison report which you will receive via email.

We’ll discuss this over online conference, telephone or in person to answer any questions you may have about the loans recommended to you.

At this stage, the Loan Comparison Report will generate loans that are an approximate 80% match to your lending requirements. We’ll keep all

your initial goals and key features top of mind when sourcing the right lenders for you.

Ready to go further?

To proceed further into the loan process and ensure we have the same end goal in mind, we ask that you formally engage SMART Mortgage &

Lending to act as your mortgage broker, by;

E-Sign the Engagement Letter

Upload more

detailed documents and information into the secure client portal (You’ll receive a Loan

Document Checklist

as a guide on which information is required).

Step 3: Formal Loan Recommendation & Loan Application

Now we’ve drilled down into the details, we will produce a Formal Loan Recommendation report for

you.

Next Steps

If you wish to go ahead with the loan that we’ve recommended for you, we’ll do a few things:

A phone call or face to face meeting to answer any questions you may have about the loan recommendation

Send you a Loan Application Form from the lender.

Loan Application

The Loan Application is a detailed process, and it can vary from lender to lender.

There may be pieces of information that the lender requires to keep the application moving through the pipeline. We will remain in close

contact with the lender on your behalf and will call and/or SMS you should there be any further information required from you.

Occasionally the lender may reach out to you directly for information. If you are unsure of progress at any stage please contact us directly

for clarification.

We will submit the loan application to the lender on your behalf.Conditional Approval stage.

A few points to note

This step involves a lot of admin from our end. The implementation and progress of your Loan Application will vary greatly from person to

person, from lender to lender.

Rest assured we aim to maintain consistent contact with you and your providers to expediate the process where possible.

Step 4: Conditional Approval

Conditional approval means that the mortgage underwriter is mostly satisfied with your entire

loan application, but still sees something that needs to be resolved. These issues are referred to as “conditions”.

The conditional approval signifies that if you meet the remaining conditions, the loan will be approved .

Often referred to as a pre-approval , this step is necessary to confidently go to market with

clarity of how much a lender is willing to loan to you.

MILESTONE: Loan Approval

Here’s what happens:

Formal Approval sent to our broker from the lender

We’ll contact you with the good news

Lender will send you the formal loan docs (email or posted)

You must sign the docs and send back to the lender promptly

Step 5: Sign Loan Documents & Book Settlement

We’re at the pointy end of the transaction now. Here’s an overview of what’s happening in the background:

Loans documents verified by;

Settlement is booked by lender

Lender notifies us (your broker) of Settlement Date

We’ll notify you of the Settlement Date – via SMS and ph call

Plan for successful settlement

We’ll be in contact by phone and email prior to settlement to ensure you

have the correct funds in the correct accounts.

*If you do not have a solicitor / conveyancer that you have already engaged, we can assist with providing a list of professionals that may

be able to assist you.

Step 6: Settlement

When the money officially changes hands!

We’re notified by the lender that settlement has happened

We’ll call or SMS you notifying that the loan has settled.