A bridging loan is a short-term loan that helps bridge the financial gap between the purchase of a new property and the sale of an

existing property. It is designed to provide temporary funding to cover the period when you have bought a new property but have not yet

sold your current property or received the proceeds from its sale. Typically, there is a timeframe of 6 months to sell your current

property when obtaining a bridging loan. However, if you are in the process of constructing a new property, this timeframe is usually

extended to 12 months.

How does a bridging loan work?

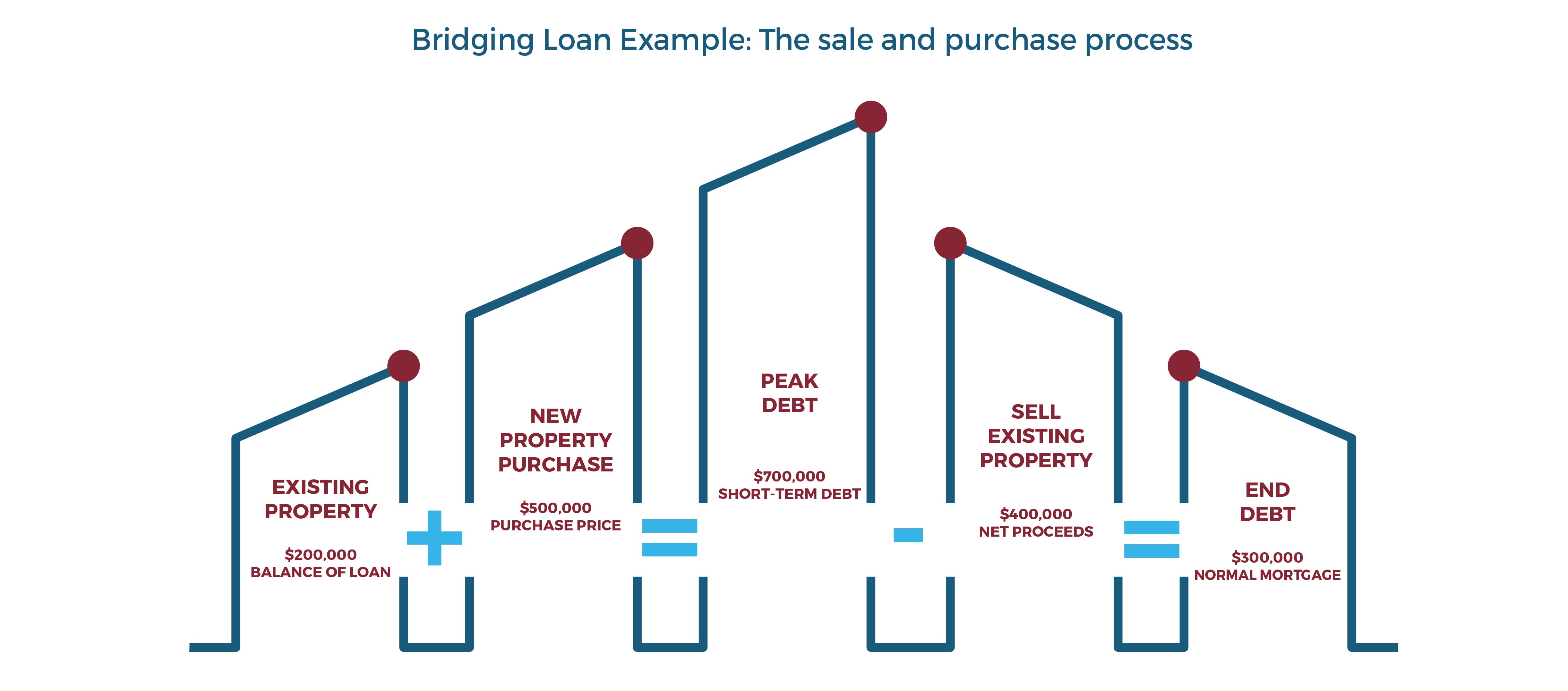

When obtaining a bridging loan, the lender

typically assumes responsibility for both your existing property's mortgage and the financing of the new property purchase. The

total amount borrowed, known as the Peak Debt, encompasses the outstanding loan balance on your current home, the contractual purchase

price of the new home, and additional expenses such as stamp duty, legal fees, and lender fees.

How are payments calculated on a bridging loan?

The minimum repayments on a bridging loan are usually calculated based on the interest-only principle. In many cases, this interest can

be accumulated, or capitalized, until the sale of the existing home occurs. This means that the accrued interest is added to the Peak

Debt.

Once you successfully sell your first property, the net proceeds from the sale (sale price minus any selling costs like agent fees) are

utilized to decrease the Peak Debt. The remaining debt then transforms into the End Debt, which is repaid through a

standard mortgage product from that point onward.

Applying for a bridging loan can be intimidating for borrowers. Our mortgage brokers at Smart Mortgage & Lending are experts at all borrowing scenarios, helping you secure your next property.